The Single Strategy To Use For Unicorn Financial Services

Wiki Article

The smart Trick of Mortgage Broker Melbourne That Nobody is Discussing

Table of ContentsThe Facts About Mortgage Broker Melbourne RevealedUnicorn Financial Services Fundamentals ExplainedLittle Known Facts About Mortgage Broker In Melbourne.Refinance Broker Melbourne - An OverviewThe 2-Minute Rule for Refinance Melbourne

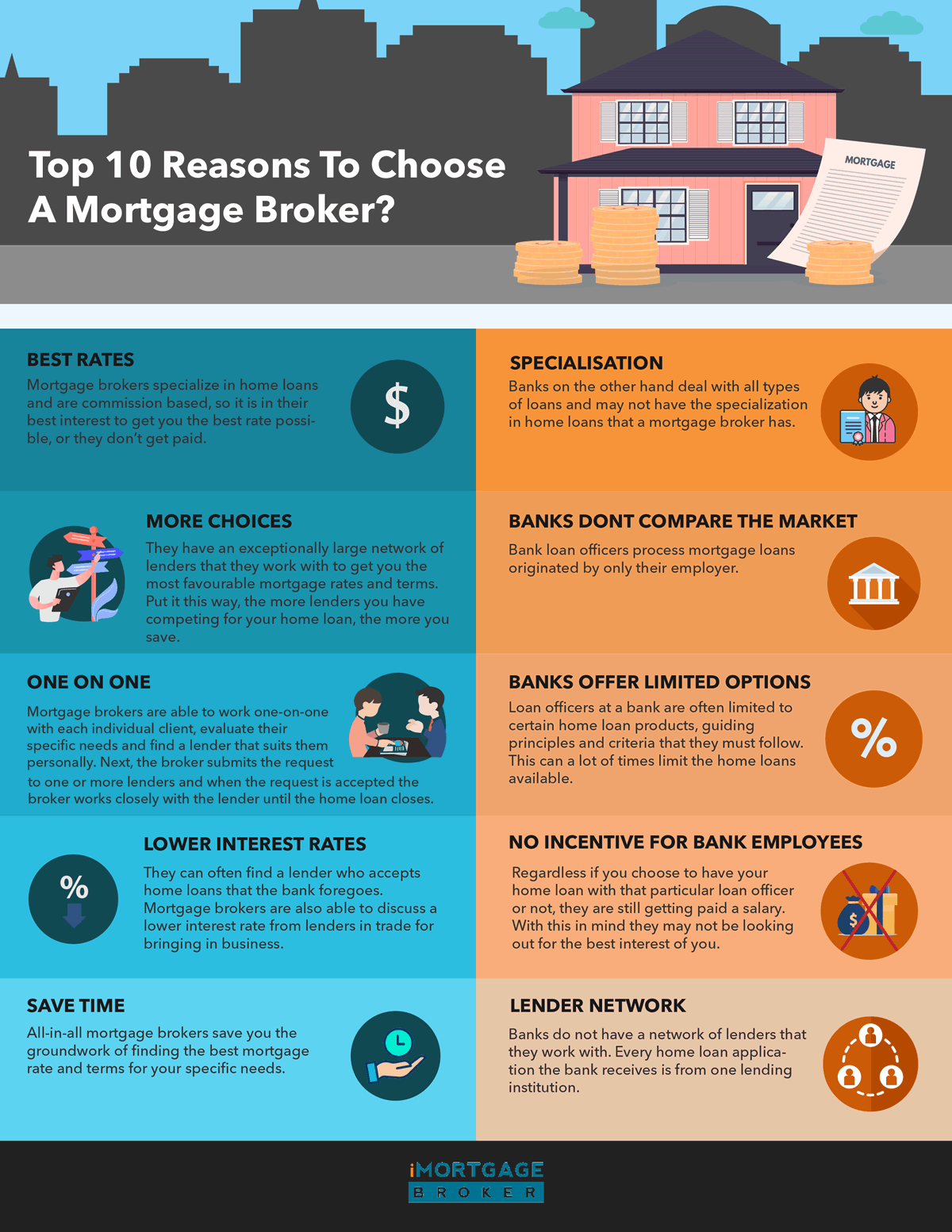

A professional mortgage broker comes from, discusses, and processes residential and business home loan finances in behalf of the client. Below is a 6 factor guide to the solutions you need to be offered as well as the assumptions you need to have of a certified mortgage broker: A home loan broker supplies a vast array of home loan from a number of different loan providers.A home loan broker represents your interests instead than the rate of interests of a loan provider. They must act not just as your agent, however as an experienced consultant and trouble solver. With access to a large range of mortgage products, a broker has the ability to supply you the best value in regards to rate of interest, repayment quantities, and also lending products (refinance broker melbourne).

Numerous scenarios require even more than the straightforward use a thirty years, 15 year, or flexible price home mortgage (ARM), so innovative mortgage strategies and advanced remedies are the benefit of dealing with a skilled home loan broker (https://top50bizcitations.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker navigates the customer through any type of scenario, handling the procedure and also smoothing any kind of bumps in the road along the road.

Borrowers who locate they need bigger loans than their bank will certainly authorize likewise take advantage of a broker's knowledge and also capability to effectively get financing. With a home loan broker, you just need one application, as opposed to finishing types for each and every private lending institution. Your home mortgage broker can provide an official contrast of any kind of finances advised, guiding you to the information that accurately depicts expense distinctions, with current prices, points, as well as closing expenses for every lending mirrored.

See This Report about Melbourne Broker

A reliable home loan broker will certainly reveal just how they are paid for their services, along with detail the overall expenses for the car loan. Personalized solution is the separating variable when choosing a home loan broker. You need to anticipate your home mortgage broker to assist smooth the way, be available to you, and also encourage you throughout the closing process.

Collaborating with a home mortgage broker can potentially conserve you time, effort, as well as money. A home loan broker might have far better as well as more accessibility to lending institutions than you have. However, a broker's rate of interests might not be straightened with your own - loan broker melbourne. You might obtain a better deal on a funding by dealing directly with lending institutions.

All about Melbourne Broker

A home mortgage broker does as arbitrator for a financial institution that supplies finances that are secured see this here with realty and individuals who intend to acquire property and need a financing to do so. The mortgage broker collaborates with both borrower and also lending institution to obtain the borrower approved for the car loan.A mortgage broker commonly works with many various lending institutions and can supply a selection of car loan alternatives to the consumer. A debtor does not have to function with a home loan broker.

While a home loan broker isn't necessary to promote the deal, some lenders may only function with home mortgage brokers. If the lending institution you favor is among those, you'll need to make use of a mortgage broker.

They're the individual that you'll handle if you approach a lender for a lending. The loan officer can aid a debtor understand and also select from the lendings supplied by the lending institution. They'll answer all concerns, assist a debtor get pre-qualified for a loan, and also assist with the application process.

The Of Loan Broker Melbourne

Home mortgage brokers don't give the funds for financings or accept loan applications. They help people looking for home mortgage to find a lender that can money their house acquisition. Start by making certain you recognize what a home loan broker does. Ask buddies, family members, as well as service acquaintances for references. Have a look at on-line evaluations and check for issues.Ask concerning their experience, the specific aid that they'll give, the fees they bill, and exactly how they're paid (by lending institution or debtor). Ask whether they can help you in specific, provided your specific monetary circumstances.

Faced with the issue of whether or not to utilize a home loan broker or a loan provider from a bank? When you are looking to buy a residence, nevertheless, there are 4 crucial aspects that mortgage brokers can offer you that the loan providers at the bank just can not.

Individual touch seems to be progressively much less usual in today's culture, but it shouldn't be. None people live the same life as an additional, so customization is essential! Purchasing a house is type of a large deal! At Eagle Home mortgage Business, individual touch is something we satisfaction ourselves in. You reach collaborate with one of our agents directly, that has years of experience and also can address any concerns you might have.

Indicators on Refinance Broker Melbourne You Need To Know

Financial institutions, on the various other hand, have a limited routine. Their hours of operation are typically while you're currently at work. Who has the moment for that? And also, every vacation is a national holiday. Get the individual touch you should have with a mortgage broker that cares! The flexibility a home mortgage broker can use you is just another factor to stay clear of going to the financial institution.

Report this wiki page